The market has been shaky for months. The recent crypto crash has pushed many prices down and shaken weak hands. But history shows that these periods often create the best entry points. When fear is high and prices are still calm, smart investors prepare for the next move up. As signs slowly point toward recovery, some projects stand out more than others. Among them, Mutuum Finance (MUTM), XRP, and Cardano (ADA) continue to attract attention for very different reasons. While XRP and Cardano (ADA) are well-known names, Mutuum Finance (MUTM) is still early. That early stage is exactly why many investors are watching it closely before the market turns bullish again.

XRP (XRP)

As of January 27, 2026, XRP is consolidating around $1.88–$1.90 after failing to break above the $2.00 resistance, with the Fear & Greed Index showing extreme fear (20–29). The market faces short-term bearish pressures, testing support near $1.80–$1.86, while resistance sits at $2.10–$2.30. Technicals indicate a strong sell on moving averages, with RSI at 46, and a descending triangle or wedge pattern suggests a possible short-term low before a rebound. Mixed ETF flows, institutional adoption, and the upcoming 1B XRP escrow unlock create cautious sentiment, keeping XRP neutral until bulls regain key levels.

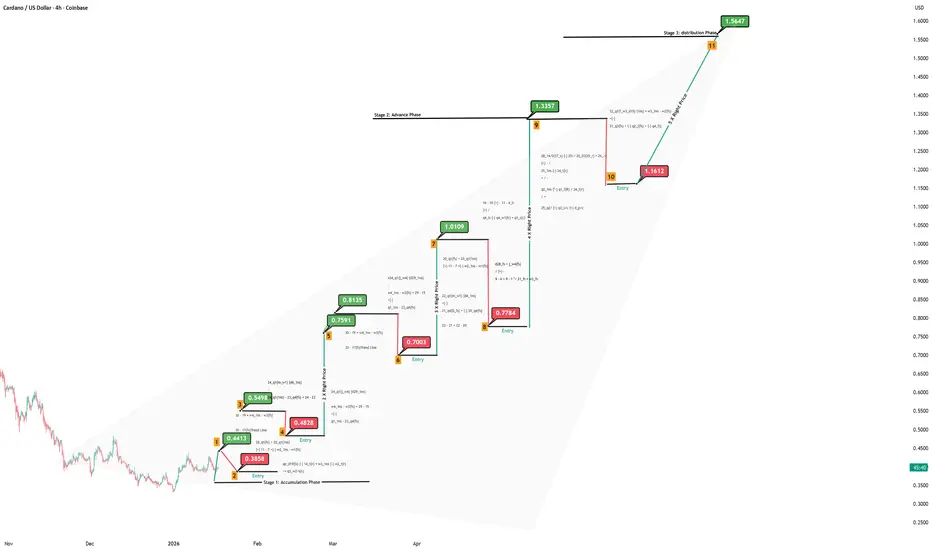

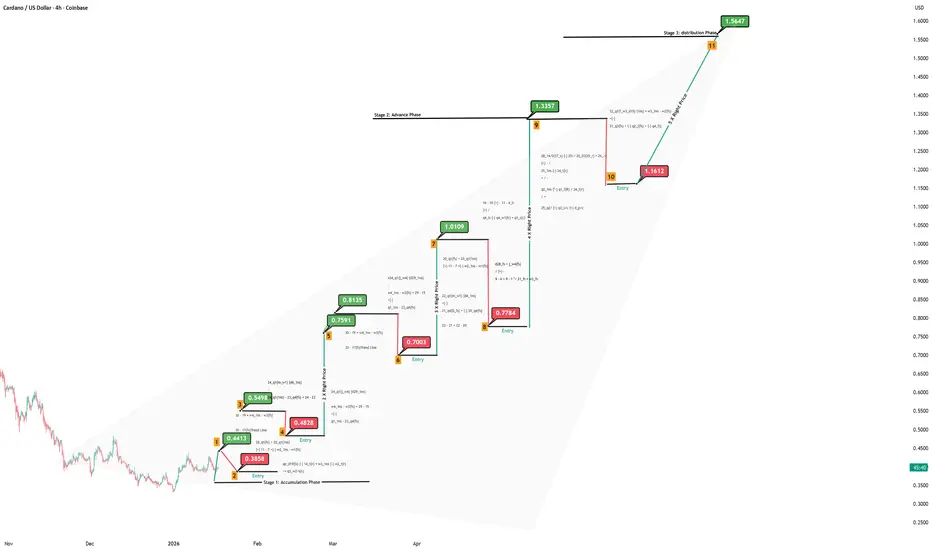

Cardano (ADA)

Cardano (ADA) is trading on Coinbase against the USD, showing promising distribution levels that suggest strong potential for upward momentum. Key zones at $0.4413, $0.5498, $0.7591, $0.8135, $1.0109, $1.3357, and $1.5647 highlight areas where buying interest has historically been strong, providing solid support for bullish moves. ADA appears poised to test higher distribution levels, with mid-range zones offering a foundation for sustained gains. With growing adoption and positive market sentiment, ADA’s price could continue climbing, aiming to break above previous resistance levels and potentially reach new highs in the near term.

Mutuum Finance (MUTM) Presale Momentum and Early Opportunity

Mutuum Finance (MUTM) is currently in presale phase 7, with the token priced at $0.04. The total supply is fixed at 4 billion tokens, and combining all presale phases so far, the project has already generated around $20.20 million. More than 19,000 holders have joined across all phases, showing strong and growing interest.

Security is another major factor. In November 2025, Mutuum Finance (MUTM)’s smart contracts underwent a formal audit by Halborn, a respected blockchain security firm. The review flagged six issues, including one high-severity finding, all of which were fully resolved by the team. Halborn confirmed that 100% of reported findings were remediated.

Utility, Growth Drivers, and Why MUTM Stands Out

Mutuum Finance (MUTM) is designed as a decentralized lending and borrowing protocol with dual lending models. These models are peer-to-contract (P2C) and peer-to-peer (P2P). In the P2C model, users interact directly with liquidity pools managed by smart contracts. Lenders deposit assets into pools, while borrowers draw liquidity against collateral. In the P2P model, lenders and borrowers connect directly, allowing more customized terms between participants. This dual approach gives users flexibility and broadens the platform’s appeal.

The launch of Mutuum Finance (MUTM) V1 on the Sepolia testnet marks the project’s first live deployment in an environment close to mainnet conditions. This allows users to test the system without financial risk while helping the team refine the protocol through real activity. V1 introduces asset-based liquidity pools, mtTokens that earn interest, transparent debt tokens, automated liquidations, and support for ETH, USDT, LINK, and WBTC.

A practical example shows how this works. A lender could deposit $2,500 in USDT and receive mtUSDT, which grows in value as borrowers pay interest. On the borrowing side, a user could lock $5,000 worth of WBTC as collateral and borrow $3,000 in USDT. This allows access to funds without selling assets during a dip, a key advantage during uncertain market conditions.

These mechanics create a self-sustaining cycle. Lenders earn yield. Borrowers gain flexibility. Platform activity increases. As users interact with mtTokens and debt positions, MUTM becomes tied to real usage rather than pure speculation. This is a major growth driver, especially as defi crypto adoption continues to expand after the crypto crash.

Mutuum Finance (MUTM) also includes a buy-and-distribute mechanism. Part of the platform’s revenue from lending and borrowing will be used to repurchase MUTM tokens from the open market. These tokens will then be distributed to mtToken stakers as rewards. This structure encourages long-term participation and creates ongoing buy pressure as platform usage increases. Over time, higher activity means more revenue, more buybacks, and stronger demand for MUTM.

Community Growth

Community growth adds another layer. The project has already built a following of over 12,000 on Twitter. An $100K giveaway has already been running, with ten winners receiving $10,000 worth of MUTM each. The dashboard is already live, allowing users to track holdings and estimate potential returns. A Top 50 leaderboard rewards the largest contributors with bonus MUTM tokens. A daily 24-hour leaderboard also offers $500 in MUTM to the top-ranked user each day, provided they complete at least one transaction. These features keep engagement high and reward active supporters.

XRP and Cardano (ADA) remain solid projects with established ecosystems and long-term visions. However, their size means growth may be steadier rather than explosive. Mutuum Finance (MUTM), by contrast, is still early, utility-driven, and positioned to benefit strongly as sentiment shifts positive again.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance