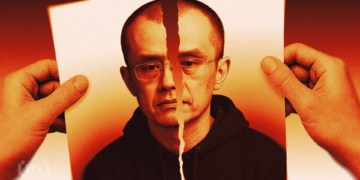

OKX CEO Star Xu said the October 10 crash was not an accident but was the result of high-risk yield campaigns tied to USDe that normalized hidden leverage, pushing back after Binance released a report attributing the turbulence to macroeconomic shocks and market-structure issues.

In a statement issued on Friday, Xu argued that the incident, which triggered over $19 billion in liquidations within 24 hours and affected 1.6 million traders, “was caused by irresponsible marketing campaigns by certain companies.”

“We observed clearly that the crypto market’s microstructure fundamentally changed after that day,” Xu stated. “Many industry participants believe the damage was more severe than the FTX collapse.”

According to Xu, systemic risk had built up quietly across platforms before being exposed by market volatility.

He said the root of the problem was user-acquisition campaigns that promoted double-digit yields on USDe while allowing it to be used as collateral and treated with the same risk assumptions as USDT and USDC.

“USDe is fundamentally different from products such as BlackRock BUIDL and Franklin Templeton BENJI, which are tokenized money market funds with low-risk profiles. USDe, by contrast, embeds hedge-fund-level risk,” Xu noted.

In practice, USDe traded as if it were interchangeable with stablecoins despite a materially higher risk profile, the OKX CEO stated, adding that this encouraged leverage loops in which users repeatedly swapped USDT and USDC into USDe, borrowed against it, and recycled the proceeds to chase yield, pushing headline APYs from 24% to more than 70%.

When market volatility rose on October 10, Xu said even a relatively small market shock was enough to trigger a rapid breakdown. USDe depegged, liquidations cascaded across venues, and weaknesses in risk management around other assets such as WETH and BNSOL amplified losses, with some tokens briefly trading near zero.

He said the impact on global users and companies, including OKX customers, was severe and recovery would take time.

“I am discussing the root cause, not assigning blame or launching an attack on Binance. Speaking openly about systemic risks is sometimes uncomfortable, but it is necessary if the industry is to mature responsibly,” Xu explained, pointing out that Binance bears an outsized responsibility for market stability.

The crash occurred amid heightened volatility following Donald Trump’s announcement of a 100% tariff on Chinese imports. High leverage across centralized exchanges compounded the selling pressure.

ARK Invest CEO Cathie Wood said on ‘The Claman Countdown’ this month that the severity of the crash was linked to a software glitch at Binance, calling it an “aftershock” of prior market instability.

Xu previously pointed to an “industry-leading company” as a primary culprit, accusing the exchange of manipulating low-quality tokens in ways he compared them to Ponzi schemes. He claimed that such practices had eroded trust across the crypto industry.

In its report, Binance said the crypto crash was triggered by macroeconomic shocks, elevated leverage across the market, market makers pulling liquidity under extreme volatility, and Ethereum’s network congestion.

Binance said its systems stayed operational during the selloff, with minor issues occurring after most liquidations. The exchange has compensated affected users and improved safeguards after the event.